You can better plan for future expenses.Ī relatively short average collection period means your accounts receivable collection team is turning around invoices quickly and everything is operating smoothly.It’s easier to compare collection periods with competitors.Cashflow freedom keeps your business afloat.What’s more, your average collection period contributes directly to achieving company goals and growing your business.Ĭalculating your collection period is important because: Shorter, lower, higher: Your goal is for clients to spend less time in accounts receivable and more time paying bills promptly. The shorter your collection period-or the lower your DSO/higher your accounts receivable turnover-the better. Prompt, complete payment translates to more cash flow available and fewer clients you must remind to pay every month. It makes sense that businesses want to reduce the time it takes to collect payment from a credit sale.

#Account receivable turnover in days how to#

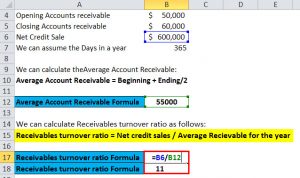

Want to improve your DSO? Download this eBook to understand how to enhance your collections process with automation Download Now Why Calculating Your Collection Period Is Important The second equation divides 365 days by your accounts receivable turnover ratio.ģ65 ÷ A/R turnover = average collection periodģ65 ÷ (net credit sales ÷ average A/R balance) = average collection periodĮxample: 365 ÷ ($800,000 ÷ $50,000) = 22.8 days average collection periodīoth equations will produce the same average collection period figure if you have the appropriate data. (A/R balance ÷ total net sales) x 365 = average collection periodĮxample: ($50,000 ÷ $800,000) x 365 = 22.8 days average collection periodĢ.

The first equation multiplies 365 days by your accounts receivable balance divided by total net sales. There are two A/R collection period formulas you can use for calculating your average collection period:ġ. This is also called your “A/R turnover ratio.” You can determine net profits by comparing net credit sales during the period (most often a year or 6 months) and your average accounts receivable balance during the period. This figure is best calculated by dividing a yearly A/R balance by the net profits for the same period of time. Typically, the average accounts receivable collection period is calculated in days to collect. How to Calculate Your A/R Collection Period Measuring this performance metric also provides insights into how efficiently your accounts receivable department is operating. You can understand how much cash flow is pending or readily available by monitoring your average collection period. Your collection period tells you how long it takes after a credit sale to receive payment. What Is an Accounts Receivable Collection Period?īusinesses often sell their products or services on credit, expecting to receive payment at a later date. It’s smart to know how to calculate your collection period, understand what it means, and how to assess the data so you can improve accounts receivable efficiency. Your average A/R collection period is an important key performance metric (KPM). Other common names include “days sales in accounts receivable,” “average receivables collection period,” or “ days sales outstanding (DSO).” Once an invoice hits accounts receivable (A/R), it enters what’s called the collection period.

Net income and sales operate on a delayed schedule, and companies crunch the numbers expecting to settle invoices and get paid sometime in the future.

#Account receivable turnover in days free#

This means that on average company XYZ collected its average accounts receivable 1.6 times during 2021.Do you want a FREE Gaviti Collections Dashboard? Register here >īusinesses often rely on cash flow that they haven’t yet received. Its accounts receivable at the end of 20 is 1,000 and 1,500 respectively.Īccount Receivable Turnover Ratio = 1.6 XYZ Company sold $2,000 of good by credit in 2021. Example of Accounts Receivable Turnover Ratio Note: Net credit sales is reflected on the Income Statement, and Accounts Receivable is on the Balance Sheet. FormulaĪccounts Receivable Turnover Ratio = (Net Credit Sales / Average Accounts Receivable) Overall, a high ratio indicates that your business is efficient at collecting and has extended credit to quality customers that pay their bills. It is an essential piece of understanding the efficiency of your organization's cash flow process. Monitoring this metric is essential to ensure that accounts receivable is collecting from customers in a timely manner. This indicator measures the amount of times that your account receivable has been converted to cash during a certain period of time (month, quarter, year). The Accounts Receivable Turnover is a KPI that measures the rate at which your company collects on outstanding receivable accounts.

0 kommentar(er)

0 kommentar(er)